2026 Cost of Living in Colombia: Everything You Need to Know

Find a Place to Explore: Booking.com

Consider various accommodation options based on your budget and preferences.

Booking.com offers a wide range of choices for every traveler.

Make your reservations early to secure the best rates.

Be sure to check reviews from previous guests before finalizing your stay.

Keep an eye on cancellation policies to ensure flexibility in your plans.

Enjoy your trip and make the most of your europe travel experience!

As of 2025: Examples

2026 Cost of Living in Colombia: The Ultimate Guide to Visas, Housing, and Lifestyle

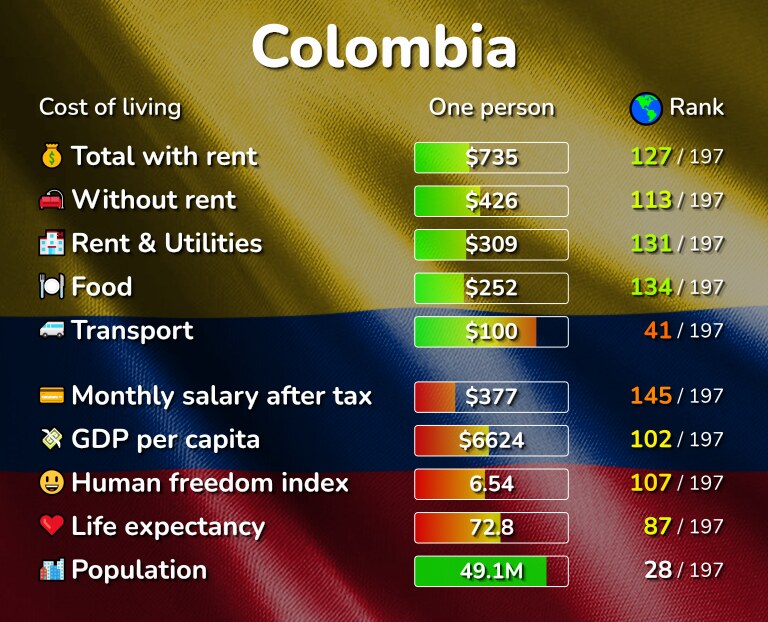

For over a decade, Colombia has been the “crown jewel” of the digital nomad and retiree circuit. However, as we step into 2026, the landscape has fundamentally changed. Between a massive hike in the national minimum wage and the stabilization of the Colombian Peso (COP) against the USD and Euro, the “dirt cheap” days of 2020 are officially over.

But don’t let the headlines discourage you. While the 2026 Cost of Living in Colombia has increased, the value proposition remains one of the best in the Western Hemisphere. You can still maintain an “Upper-Middle Class” lifestyle here—complete with a private driver, domestic help, and fine dining—for the price of a cramped studio apartment in Florida, Madrid, or London.

In this comprehensive 2,000-word guide, we will break down the exact numbers you need to survive and thrive in Colombia this year, from new visa income floors to city-specific rent tables.

1. The “2026 Visa Shock”: New Income Requirements

The most critical factor for any expat in 2026 is the Salario Mínimo Mensual Legal Vigente (SMMLV). In Colombia, the minimum wage isn’t just a labor statistic; it is the legal yardstick used to calculate visa eligibility, traffic fines, and health insurance brackets.

As of January 1, 2026, the Colombian government set the base minimum wage at $1,750,905 COP. When you include mandatory transport subsidies, the “real” floor is closer to $2,000,000 COP. Because most residency visas are pegged to this number, the “entry price” to live in Colombia has spiked significantly compared to last year.

The Pensionado (Retirement) Visa

To qualify for a Retirement Visa (Migrant M-type) in 2026, you must prove a permanent monthly pension income of at least 3 times the minimum wage.

The 2026 Requirement: $5,252,715 COP per month.

USD Equivalent: Approx. $1,385 – $1,450 USD (depending on the day’s exchange rate).

Expert Strategy: Immigration officers are being stricter in 2026. If your social security check is exactly $1,400, a minor currency fluctuation could cause your visa to be “Inadmitted.” We strongly recommend showing a “buffer” income of at least $1,650 USD to ensure a smooth approval process.

The Digital Nomad Visa (V-Nómada Digital)

The popular Digital Nomad Visa also requires an income of 3 SMMLV. In 2026, the Ministry of Foreign Affairs (Cancillería) has begun requesting 6 months of bank statements rather than 3. They want to see a consistent deposit of at least $5.25 Million COP equivalent.

Note: You cannot work for Colombian companies on this visa; your income must originate from outside the country.

The Real Estate Investor Visa

If you are looking to buy your way into residency, the 2026 threshold for the M-type Investment Visa is 350 minimum wages.

2026 Requirement: Approx. $612,816,750 COP.

USD Equivalent: Approx. $162,000 USD.

2. Housing: The “Estrato” System and 2026 Rental Markets

You cannot accurately calculate the 2026 Cost of Living in Colombia without understanding the Estrato system. Neighborhoods are ranked 1 through 6 based on the perceived wealth of the area.

Estratos 1-3: These areas receive government subsidies for water, gas, and electricity.

Estrato 4: The “Middle Ground.” No subsidies, but no “wealth tax” on utilities either.

Estratos 5-6: The luxury zones. Residents here pay a 20% surcharge on their utility bills to help subsidize Estratos 1 and 2.

City-by-City Rent Breakdown (Monthly Average)

In 2026, the “Medellín Effect” has caused prices in El Poblado and Laureles to skyrocket. Many expats are now looking toward Cali and Pereira for better value.

| City | Neighborhood | Type | Monthly Rent (COP) | USD Approx |

| Medellín | El Poblado | 1BR Modern | $5,500,000 – $8,000,000 | $1,450 – $2,100 |

| Medellín | Laureles | 2BR Traditional | $4,000,000 – $5,500,000 | $1,050 – $1,450 |

| Cali | El Peñón / Oeste | 1BR Luxury | $3,000,000 – $4,200,000 | $790 – $1,100 |

| Bogotá | Chicó / Rosales | Studio Modern | $4,500,000 – $6,000,000 | $1,180 – $1,580 |

| Pereira | Pinares | 2BR Modern | $2,800,000 – $3,500,000 | $740 – $920 |

Pro-Tip for 2026: Short-term Airbnb rentals in Medellín have faced new regulations this year. For any stay over 30 days, look for “Contratos de Arrendamiento” (Long-term leases) to save up to 40% on the monthly rate.

3. The Daily Grind: Food, Utilities, and Lifestyle Expenses

While rent prices have risen, the “boots on the ground” costs remain very affordable for those earning in foreign currency.

Groceries and Local Markets

Inflation in 2026 has stabilized at around 4%. A single person shopping at a mix of high-end supermarkets (like Carulla) and local discount stores (like D1 or Ara) should budget the following:

Milk (1L): $4,800 COP ($1.25 USD)

Eggs (Dozen): $9,500 COP ($2.50 USD)

Local Beef (1kg): $32,000 COP ($8.40 USD)

Avocados (Local Market): $4,000 COP each ($1.05 USD)

Total Monthly Grocery Budget: $1,200,000 – $1,500,000 COP ($315 – $395 USD).

Dining Out: From Street Food to Fine Dining

The “Corrientazo” (Set Lunch): A staple of Colombian life. Includes soup, main, side, and juice. 2026 Price: $18,000 – $25,000 COP ($4.75 – $6.50 USD).

Mid-Range Dinner for Two: A 3-course meal with a bottle of wine in a nice area like San Antonio (Cali) or Usaquén (Bogotá). 2026 Price: $280,000 COP ($74 USD).

Specialty Coffee: A high-end pour-over at a “Third Wave” coffee shop. 2026 Price: $9,000 – $14,000 COP ($2.30 – $3.60 USD).

4. Healthcare: EPS vs. Medicina Prepagada

Colombia’s healthcare system is world-class, consistently outranking the US and Canada in terms of efficiency and outcomes.

The Public System (EPS)

Once you have your Cédula de Extranjería (Foreigner ID), you are required to join an EPS (Entidad Promotora de Salud).

Cost: 12.5% of your declared income. For most retirees, this ends up being roughly $450,000 – $650,000 COP ($120 – $170 USD) per month.

The Catch: EPS involves wait times and paperwork. It is great for emergencies and high-cost surgeries but slow for seeing a specialist.

Private/Prepaid Insurance (Medicina Prepagada)

Most expats in 2026 opt for Medicina Prepagada (e.g., Sura, Colsanitas).

Cost: For a healthy 45-year-old, expect to pay $550,000 – $900,000 COP ($145 – $235 USD).

The Benefit: You can book an appointment with a cardiologist or dermatologist directly, often for the following day. Copays are minimal (usually around $10 USD).

5. Transportation and Connectivity

Mobile Plans: A 5G plan with 100GB of data from Claro or Tigo costs $55,000 COP ($14 USD) per month.

Home Internet: 500Mbps fiber-optic (now common in major cities) costs $115,000 COP ($30 USD) per month.

Taxis & Rideshares: Uber, Didi, and InDrive are ubiquitous. A 15-minute cross-town ride averages $15,000 COP ($4 USD).

Domestic Travel: Flights between Medellín and Cartagena on budget carriers like Wingo can be as low as $180,000 COP ($47 USD) if booked in advance.

6. The “Invisible” Costs: Domestic Help and Maintenance

One of the greatest luxuries of the 2026 Cost of Living in Colombia is the affordability of personal services.

Housekeeper (Once a week): A full day of cleaning, laundry, and cooking usually costs $90,000 – $110,000 COP ($24 – $29 USD) plus transportation.

Private Driver: A full-time driver for a family averages $3,500,000 COP ($920 USD) per month.

Gym Membership: A premium membership at a chain like Bodytech costs $180,000 COP ($47 USD) per month.

7. Regional Comparison: Where is the Money Going?

Why Medellín is the Most Expensive

Medellín has become a victim of its own success. In 2026, the influx of US-based remote workers has created a “bubble” in El Poblado. If you choose Medellín, your rent will be 50% higher than in the rest of the country.

Why Cali is the “Smart Play” for 2026

As highlighted in our guide to [Salsa and Romance in Cali], the city offers a “big city” experience with “small city” prices. You can live in a luxury penthouse in Barrio Cristales for the price of a studio in Medellín.

The Coffee Triangle (Pereira/Armenia/Manizales)

This region is the 2026 winner for retirees. It offers the best climate (Eternal Spring), the lowest crime rates in urban centers, and a cost of living that is 20% lower than Bogotá.

8. Summary: Sample 2026 Monthly Budgets

The “Frugal Nomad” (Cali or Pereira) – Total: $1,200 USD

Rent (Small 1BR, Estrato 4): $600

Groceries (Cooking at home): $250

Utilities & Internet: $80

Socializing & Transport: $200

Basic EPS Health: $70

The “Comfortable Retiree” (Medellín/Bogotá) – Total: $2,500 USD

Rent (Modern 2BR, Estrato 6): $1,500

Weekly Housekeeper: $120

Dining Out (3x week): $400

Medicina Prepagada (Private Health): $180

Private Uber/Taxis: $100

Miscellaneous/Travel: $200

Conclusion: Planning Your Move

The 2026 Cost of Living in Colombia proves that while the country is no longer a “secret,” it remains a sanctuary for those looking to escape the hyper-inflation of North America and Europe. The key to success in 2026 is flexibility. By looking outside of the El Poblado bubble and embracing cities like Cali or the Coffee Triangle, you can unlock a lifestyle that is simply unattainable elsewhere.

Are you ready to make the jump? Be sure to check our updated guide on [The Best Neighborhoods in Colombia for Expats] to find your perfect base!